The Landmark 鼎瑞苑

Can you still enter today?

Artist Impression (The Landmark)

Launched in November 2020, The Landmark has captivated many buyers with its remarkable charm, boasting 91% sold as of April 2024. Developed by Landmark JV Pte Ltd, The Landmark is a 99-year development situated along Chin Swee Road in District 03 which embodies contemporary living with 396 units, expected to obtain a Temporary Occupation Permit in March 2026.

If you are reading this, you are probably in the market to purchase a new launch in Singapore and have been recommended this project. The big question is: With only high-floor units remaining, can you still buy into The Landmark?

Assuming you're already familiar with the fundamental details about The Landmark, let's delve into some nuanced aspects that might influence your decision.

Location

We can’t deny that The Landmark enjoys a coveted location. Nestled on Chin Swee Road, The Landmark presents a luxurious residential choice, combining upscale living with proximity to the city center. Situated on the periphery of the CBD - commuting to work is a breeze, especially for those employed in the CBD. With Outram Park MRT serving three different lines, accessibility to various parts of Singapore is incredibly convenient. However, it's important to acknowledge that the preference for the hilly walk to the MRT station is subjective and best assessed firsthand. Moreover, it's essential to consider the potential noise levels stemming from both Chin Swee Road and the Central Expressway (CTE), as well as the forthcoming development of Pearl Hill. These factors warrant careful consideration in evaluating the overall desirability and livability of the area.

Schools

It is no secret today that parents are willing to pay a premium to acquire a property near a highly sought-after primary school, aiming to increase their children's chances of securing admission to the school. While the slogan "every school a good school" holds truth, it's undeniable that some schools are in higher demand than others. This can be observed by looking at the MOE's registration data.

Schools within 1km:

Schools between 1km and 2km:

Potential Appreciation:

Many have already pointed out the possibility of benefiting from future rejuvenation initiatives in the area namely, supported by the Greater Southern Waterfront and SGH Campus Masterplan. Additionally, the Urban Redevelopment Authority (URA) announced on November 2023 - the Pearl Hills Rejuvenation plans which have generated further opportunities for prospective owners. Over the next 10 years, new public housing will be built at Pearl's Hill near Chinatown, with 6,000 housing units to be built along with a mixed-use integrated development on top of Outram Park MRT station.

Source : URA

Supply and Demand

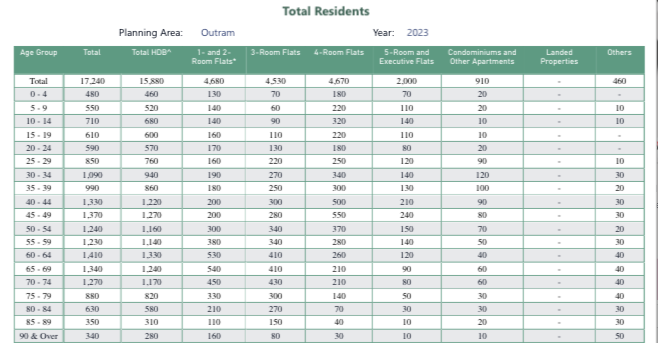

In the Outram area, there appears to be a disparity in supply, with an allocation of 17 residents per 1 condo/apartment unit. This calculation is derived by dividing the total number of residents by the total number of condos. While this method may not offer the most precise representation of supply and demand dynamics, it provides a macro-level perspective on population density and available housing options. Of particular note is the forthcoming supply in the area, including the rejuvenation of Pearl Hills, and redevelopment of Central Mall by CDL (Spoiler Alert: Union Square Residences with 366 residential units). These developments are crucial considerations when assessing the evolving landscape of supply and demand in the Outram vicinity.

Source : URA

Source : Singstat

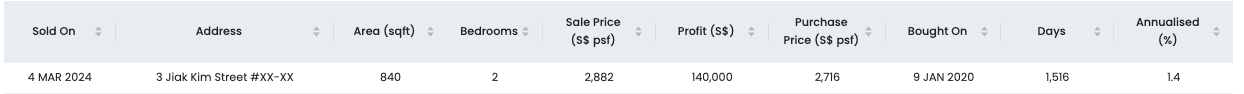

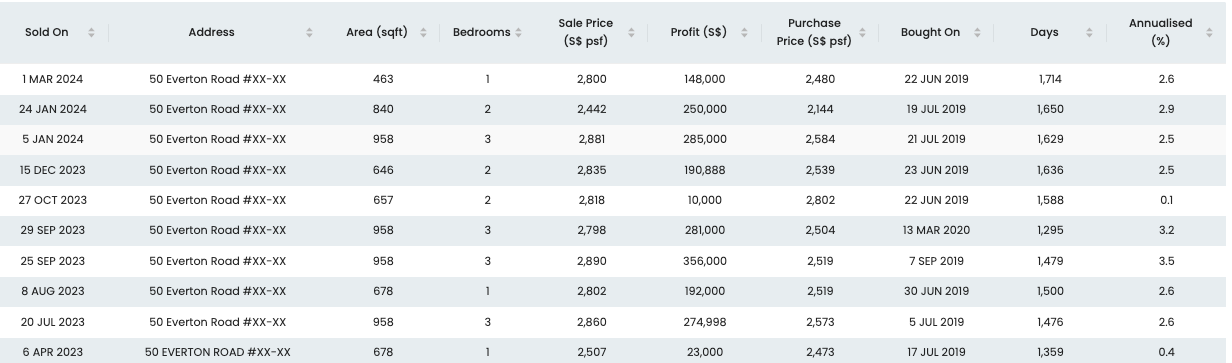

To get more realistic results, we have decided to use the sub-sale within the vicinity to track demand, namely One Pearl Bank, Riverie, and Sky Everton due to a lack of similar resale comparables. Within the past year, we can see that there is a reasonable volume of transactions noticeably in One Pearl Bank & Sky Everton, however, if we look into the profits, we notice that the returns are very marginal and lack attractiveness as an investment choice.

Sub Sale Transaction (One Pearl Bank)

Sub Sale Transaction (Riviere)

Sub Sale Transaction (Sky Everton)

Entry & Exit Price

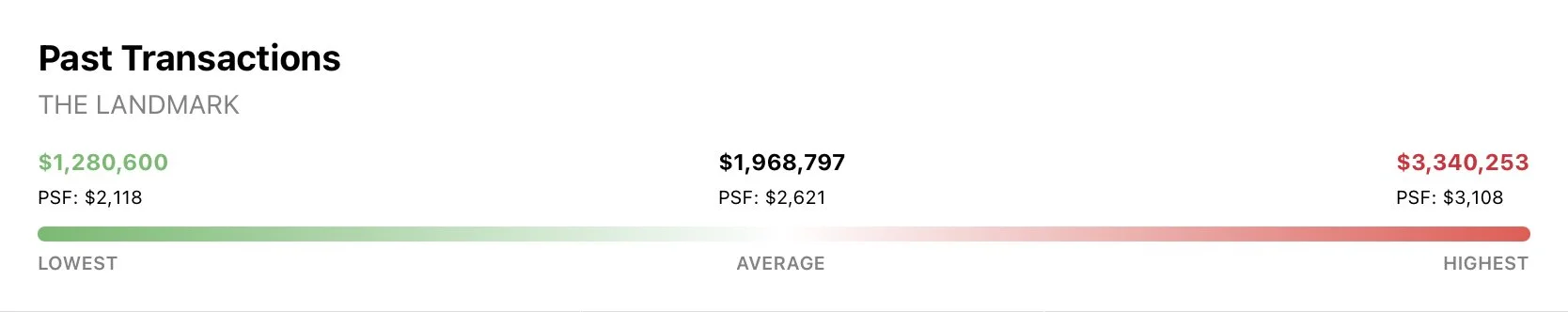

2 Years Transaction (The Landmark)

The remaining units are priced approximately $150 to $300 per square foot higher than the average price per square foot of The Landmark. This price variance is anticipated due to several price increases over the years, with remaining units at high levels commanding a premium of typically, 0.3% to 0.5% increase per floor level. Considering this, the crucial question arises: Will you be able to comfortably exit your investment when others are entering at significantly lower prices?

1 Bedroom Fr. $1,507,380 ($2,916 psf)

2 Bedroom Fr. $1,969,100 ($2,904 psf)

3 Bedroom Fr. $2,956,560 ($2,748 psf)

Looking back, when we compare the remaining prices of The Landmark with that of sub-sale units transacted, there arises a question regarding its current entry price, especially when contemplating a short-term exit strategy. In a bullish property market, the annualised returns have varied from 0.1% to 3.5%, prompting one to wonder how the investment performance would hold up in a more stable or bearish environment. Furthermore, conducting a search on PropertyGuru for resale listings in District 02 and District 03 regions within a similar price quantum as The Landmark reveals numerous alternative options worth considering - unless you have already decided on this specific locale.

So who should buy Landmark?

If you're seeking a quick turnaround on your property investment, The Landmark may not align with your objectives. However, if your goal involves fully embracing the captivating views and atmosphere of this locale in the longer term, we wholeheartedly endorse The Landmark as the ideal option for you. We anticipate that the rejuvenation of Pearl Hills will serve as a significant catalyst for price appreciation in the area in the long run. Yet, for short-term projections, we currently lack strong evidence to support anticipated price growth in the vicinity.

Want to have a deeper dive into the project or have a second opinion on your property portfolio?